Many government officials see public-private partnerships as a convenient solution to their infrastructure woes. Enlisting investors and private sector know-how gets roads, bridges and other projects built long before government could do the work on its own. And it comes without career-jeopardizing tax increases, and sometimes with deal-sweetening upfront payments.

“It’s such an easy sell to politicians, which is why we have such a hard time stopping it,” said Terri Hall, founder of Texans Uniting for Reform and Freedom, a citizens group fighting toll roads being built and operated by private investors in that state.

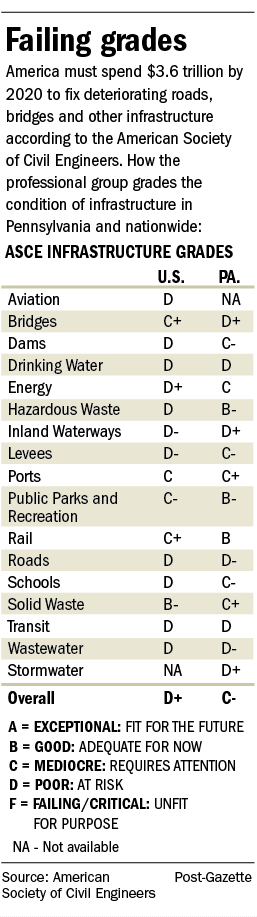

One need look no farther than the federal highway trust fund, recently rescued from the brink of insolvency by a stopgap funding measure approved by Congress, to appreciate the lack of political will to do something about America’s deteriorating infrastructure.

But states using public-private partnerships, or P3s, are discovering that what sounds like a straightforward, efficient process can be fraught with hazards. Those include negotiating an agreement that protects the public interest and monitoring that agreement over the decadeslong life of the project. Federal financing for many projects sparks concerns that taxpayers may be left on the hook.

More importantly, critics question the fundamental premise of P3s: that they cost less. They say if P3s save one part of government money, there are costs incurred elsewhere.

The Indiana Toll Road was turned over to a Spanish-Australian joint venture in 2006 for 75 years in exchange for a $3.8 billion upfront payment to the state. Since then, traffic on the 157-mile road has dropped and toll rates have skyrocketed. Tractor-trailer drivers are heading off to local roads that are not equipped to handle the increased loads. The truckers’ decision to take alternate routes is causing congestion and sparking concerns about safety and maintenance costs.

”You just can’t go around chasing public-private partnerships like they are a cash cow,” Indiana state Rep. Terri Austin told a House Transportation committee this year.

Despite their shortcomings, even critics believe the political climate makes P3s inevitable.

Mildred Warner is no fan of P3s. The Cornell University professor’s specialty is analyzing whether taxpayers are better off turning over publicly operated water and sewer systems to private operators, based on the premise that they can provide upgraded services more efficiently and at a lower cost.

Her conclusion? “There is no statistical support for cost savings in privatization of water,” Ms. Warner said.

P3 proponents dispute her findings. But they hope she is right about something else.

“I expect to see more privatization in water,” Ms. Warner predicted. “Not because it’s cheaper, but because you’ve got to get the money from somewhere.”

Circumventing democracy

Investors prefer assuming responsibility for infrastructure for a longer period of time for a number of reasons. If revenue meets projections, the longer contract increases their return. If it falls short — a common problem with P3s — an extended contract gives them the flexibility to renegotiate their debt. Contracts that run 50 years or longer allow them to claim depreciation expenses, another tool that increases returns.

But critics say signing over assets such as parking meters for 50 years or more limits the government’s flexibility to respond to changing public needs.

“A lot of it is circumventing democracy, if you will,” said Aaron Renn, an Indianapolis-based urban policy specialist. “You’re giving away urban planning ability for your streets. Who knows what we might want to do with that real estate in the future?”

Donald Cohen agrees.

“It has a huge impact on democratic decision making,” said Mr. Cohen, executive director of In the Public Interest, a Washington, D.C., think tank that analyzes terms of privatization deals.

Changes in the use of motor vehicles illustrate the concerns.

Whether measured by person, by licensed driver, by household, or by registered vehicle, driving distances peaked in 2004 and have fallen since, according to the University of Michigan’s Transportation Research Institute. The fact that reliance on motor vehicles began falling prior to the recession indicates broader, demographic trends — such as more people working from home or living in cities — are behind the downturn, according to Michael Sivak, author of the report.

At the same time, ridership on public transit has increased.

Given those developments, paying private operators to build toll roads to alleviate urban congestion may not make sense, P3 critics caution.

“The factor that none of the [state] departments of transportation want to pay attention to is that per capita vehicle miles traveled are falling,” said Stewart Schwartz, head of the Coalition for Smarter Growth, a Washington, D.C., group that backs greater use of mass transit.

Toll road operators recognize the risks from that trend, as well as others that can develop over the decadeslong life of a project. The P3 agreements they agree need to reflect those uncertainties.

“The private sector worries quite a bit about having its equity on the line and committed. You’re kind of lashed to the mast for the duration of the concession,” said Richard Fierce, an executive with Fluor Enterprises, an Irving, Texas, engineering and construction firm.

Private, but subsidized

Governments raising money for infrastructure projects have a big advantage over private investors raising funds for the same purpose. Governments can issue tax-free debt, which means lower borrowing costs. While savings from private sector ingenuity and efficiency applied over the decadeslong life of a project can make up some of the disadvantage, borrowing expenses can still be a significant hurdle for investors pursuing P3s.

So Congress has authorized the projects to use federally guaranteed loans and private activity bonds, tax-exempt financing that lowers the private sector’s borrowing costs.

“Which is a subsidy, no question about it,” said Timothy Carson, former Pennsylvania Turnpike commissioner. “That subsidy is not replicated elsewhere in the world.”

The federally backed loans, managed by the U.S. Department of Transportation, allow P3 operators to defer repayment for up to five years after a project is substantially completed, giving them 35 years to pay off the debt.

The federal loans have a short track record, but already the bankruptcy of a California toll road financed by the program raises concerns about how well taxpayers will be protected. The federal government expects to recover $140 million loaned to operators of San Diego’s South Bay Expressway, a 10-mile road that was reorganized after declaring bankruptcy in 2010.

More recently, private investors who have a 50-year concession to operate a 41-mile toll road near Austin, Texas, defaulted on $686 million in bank debt. The troubled road’s operators aren’t scheduled to begin repaying another $430 million in federal loans used to finance the $1.3 billion project until 2017. Moody’s, a credit ratings agency, does not expect toll revenue will increase fast enough to meet the project’s escalating repayment requirements.

“At the end of the day, who’s backstopping the project? If things fall apart, who’s left holding the bag? The taxpayers,” said Ryan Bowley of the Owner-Operator Independent Drivers Association, which represents professional truckers hard hit by toll increases on P3 roads.

What risk? What price?

The key to a successful P3 is determining whether it is appropriate to invite private investors to invest in the project.

If that makes sense, what follows is the arduous job of negotiating a long-term agreement that provides improved, more efficient services while protecting public interests and ensuring investors a reasonable rate of return. A critical part of those negotiations is allocating risks between the public and private partners.

“It’s all about pricing risk and assuming you’re pricing it correctly,” said San Francisco attorney Scott Douglass, who advises developers, contractors and other clients on P3 deals.

Mr. Carson, now a Philadelphia attorney who advises government clients on public finance issues, said transferring risks to the private sector is one of the biggest reasons to use P3s. If a highway project being built with a P3 goes over budget or takes longer to build than planned, those costs should fall on the private operator.

But investors will expect to be compensated for assuming that risk.

“Everybody’s in this to make a dollar and there’s nothing wrong with that in terms of a reasonable rate of return,” Mr. Carson said.

Many question just how much risk investors assume when contracts contain provisions reimbursing them if governments take actions that curb their revenue, such as adding bus or express lanes that eliminate or limit parking.

When September 2008 flooding closed a major highway, tolls were waived on the privatized Indiana Toll Road to encourage motorists to use that route. Taxpayers picked up the tab, paying $508,000 to compensate the Spanish-Australian venture operating the highway for the lost tolls.

Ellen Dannin, a former Penn State law professor who writes extensively on privatization issues, said the lease agreements, which frequently run hundreds of pages, would be much shorter and less complex if they did not have to detail how investors are compensated for their public partner’s actions.

Provisions requiring Chicago to reimburse the private operators of the city’s parking meters when parades, maintenance or other events put the meters out of service “actually puts the private operator in a much better financial position than the city,” Ms. Dannin said.

“These reimbursement terms make government the contractor’s insurer and guarantor. They operate as a form of penalty for government taking actions in the public interest,” she wrote in 2011.

The cost of oversight

Because of the exhaustive provisions that must be made for everything that could occur over the decadeslong life of the project, P3 negotiations are lengthy and expensive enough to sometimes discourage potential bidders. Each side hires lawyers, financial experts and other consultants, an arms race some believe puts government at a disadvantage.

“The people they are sitting across from at the negotiating table are high-priced lawyers who have done this a million times before,” said Phineas Baxandall of the U.S. PIRG, a coalition of state consumer watchdogs.

Mr. Fierce said negotiations are complicated because each project is different, procurement laws differ from state to state, and financing arrangements vary.

“It’s amazing how many different law firms get tied up into one of these transactions,” he said. “That’s one of the reasons that P3s in the United States have been a little bit slower to take off.”

North Carolina DOT officials had 70 one-on-one meetings with bidders to discuss recently approved plans for a $655 million, 50-year P3 that will add 26 miles of tolls lanes along a heavily traveled stretch of I-77 near Charlotte. Some of the meetings lasted two hours, while others lasted an entire day, said Rodger Rochelle, an administrator for the agency.

After a contract is negotiated, the government has to monitor the performance of the private operator.

“Just because you hand it over to private industry doesn’t mean government can wash its hands of it,” Mr. Swan said. “You don’t get completely out of that if you’re not managing that. If you do, you’re making a big mistake.”

The costs of ongoing vigilance are often understated to make it look like the partnerships are less expensive and more efficient than doing infrastructure projects the traditional way, according to Columbia University professor Elliott Sclar, a P3 critic.

Mr. Cohen of In the Public Interest said any large organization, whether government or industry, can be plagued by ineptitude and inefficiencies. So the government has to make sure the private operator abides by its commitments, monitoring the costs and benefits on an ongoing basis.

“The issue is not public or private. The issue is management,” Mr. Cohen said. “Subcontracting requires higher skilled management, not less. You have to watch it more closely and you have to plan it more carefully.”

Backlash and lessons

The early wave of P3s illustrates how hard it can be to protect the public interest. Reaction to what happened after Chicago turned over its parking to an investor group has prompted Cincinnati, New York and other cities to join Pittsburgh in rejecting doing the same thing. Chicago recently scuttled the idea of privatizing its Midway airport. Pennsylvania resisted billion-dollar proposals to privatize its turnpike and lottery.

Many industry leaders, government officials and their consultants believe P3s will only be used for a small portion of America’s massive infrastructure needs. A high-level Maryland Department of Transportation official recently told the House Transportation committee that such partnerships are only expected to account for 5 to 10 percent of the state’s capital program.

In addition to using P3s for a Baltimore port terminal and two rest stops on I-95, Maryland plans to use a P3 to build a $2.2 billion, 16-mile light rail line that will connect suburban Washington, D.C., communities with subway and bus systems as well as Amtrak. Private investors are expected to provide $500 million to $900 million of the money.

The Congressional Research Services forecasts that P3s will likely account for no more than 10 percent of highway projects over the next 20 years or so. They will probably provide a much smaller share of the funding for transit projects, the group said.

Some believe P3s should be thought of more as a way to deliver smart infrastructure faster and more efficiently rather than as a way to plug funding gaps. They are convinced projects can be more intelligently designed if government invites the private sector in early and takes advantage of the innovations it can offer.

“It’s a way to unleash more value,” Mr. Fierce said.

But they are not a cure-all, the Fluor executive warned members of the House Transportation Committee this year.

“They’re not a magic bullet that converts projects that aren’t feasible into showpieces,” Mr. Fierce testified.

To read original story, please click here.