Parking policy guru Jeff Tumlin will outline sixteen ways to tailor parking policies to meet parking demand while reducing some of the negative effects of current policies. D.C. Department of Transportation’s Associate Director Sam Zimbabwe will present the city’s latest thinking on how to take the lessons learned from around the country to craft parking policies that support community goals. Join us to learn about best practices and what D.C. government is planning to do to get parking right.

Category: District of Columbia

Testimony before the D.C. Historic Preservation Review Board, Support for McMillan Sand Filtration Plant Master Plan Update

Please accept our testimony on behalf of the Coalition for Smarter Growth. My organization works to ensure that transportation and development decisions in the Washington D.C. region accommodate growth while revitalizing communities, providing more housing and travel choices, and conserving our natural and historic areas.

We wish to express our support for the revised Master Plan for the McMillan Sand Filtration Plant proposal. The new plan takes an already thoughtful plan and provides additional open space and careful treatment of the unique historic resources of the site. The plan will restore and provide public access to key elements of the distinctive historic resources. This would not be possible without the redevelopment program that helps pay for the cost of the restoration.

We recognize that the expansion of park space on the site was in part driven by D.C. Water’s enhancement of stormwater management and flood mitigation efforts. The expanded park space, driven both by D.C. Water and public demand for a larger park, has traded off a significant loss of affordable housing for the space. This is a major disappointment and a loss of D.C.’s use of public lands to address the housing needs of many residents, especially at lower income levels of 60 percent of AMI and below.

Notwithstanding this significant loss, we recognize the important historic preservation, public space, housing, and commercial space contributions of the revised Master Plan. For decades, access to this large area was prohibited, creating a wide gap between surrounding activities and neighborhoods. The revised plan would make this historic resource featured in a major public park a citywide destination. The Master Plan honors and replicates the historic landscape elements of the Olmsted Walk that have disappeared from the site. We agree with the staff comment that additional work should be done with DDOT to ensure that the Olmsted Walk connection to the sidewalk design is more than a standard sidewalk. This might require some flexibility in DDOT’s design standards.

The plan appropriately focuses taller office buildings towards Michigan Avenue and tapers building heights and forms as the development moves south to meet rowhouse neighbors. The plan adds separation to the neighborhood to the south with a large public park. Large scale buildings are needed close to Michigan Avenue to give a sense of enclosure and connect to the Washington Hospital Center. Eventually, we hope these new buildings will encourage reconfiguration of the hospital complex to create more pedestrian-oriented designs.

Preservation of Cell 14 and recreation of the Olmstead Walk along North Capitol Street highlight the historic features of the site; however, they should be balanced with the need to support a better pedestrian environment along these busy streets by better connecting the pedestrian to adjacent uses on the site.

The plan for complementary new uses of retail, offices, and residential will strengthen the facing hospital complex and reconnect the site the city. These proposed uses are likely to build upon and amplify the contribution that current hospital center-related activities make to D.C.’s economy and employment base. While the northern components of the plan better connect the site to its surroundings, the large park and recreated Olmsted Walk also allow the site to stand out as a distinctive and special place.

Overall, we support the revised master plan as a sensitive approach to preserving and making publically accessible this industrial architectural and public works heritage. The housing, retail, and office components help address the needs of a growing city and hospital district. Given that we have already lost a significant number of low income housing units planned in the first Master Plan, we ask that historic design guidance work with existing proposed levels of housing and commercial space, and not force further reductions. While we would like to see significantly more affordable housing in this plan, the redevelopment plan does contribute to important community and citywide needs. The proposed plan for preservation and development is a compromise to enable the restoration of this distinctive historic resource.

Thank you for your consideration.

Cheryl Cort

Policy Director

D.C.-region smart-growth organization releases transit report

Earlier this week, the Coalition for Smarter Growth issued a report on the Washington, D.C. region’s public transportation, including a set of nine principles to guide long-term regional planning for the next generation of transit. The Coalition for Smarter Growth, a non-profit, works to promote smart growth in the Washington, D.C. region.

For those living or working in Washington, D.C., Maryland or Virginia who ever tried to travel to one of the three major area airports, work, or activities and errands without driving a car, they know that Metro serves as a backbone of our regional public transportation network, and they understand that this network includes numerous transit entities that cross local jurisdictional lines.

Relying in part on 2012 and 2013 reports on next-generation transit goals issued by the Metropolitan Washington Council of Governments and Washington Metropolitan Area Transit Authority, respectively, the March 4, 2013 Coalition for Smarter Growth’s primer summarizes plans to grow the Metro system and to expand public transportation.

The report discusses six ongoing transit initiatives: Metrorail’s 23-mile Silver Line extension in Virginia; a new eight-line light-rail and streetcar network throughout D.C.; Metrorail’s Purple Line cross-county connection in Maryland; a new 5-mile streetcar service along a mixed-use corridor in Arlington and Fairfax Virginia; three rapid bus transportation corridors in Alexandria and Arlington, Virginia; and a 160-mile rapid bus transportation system in Montgomery County, Maryland.

The report, “Thinking Big Planning Smart,” states that its purpose “is to get you involved in creating a vision and plan for the new public transportation investments we need to link together our region’s ever-growing number of livable, walkable centers and neighborhoods.” The Coalition offers the 35-page report as a primer on the next generation of transit and a resource on already-planned regional transit proposals in progress.

As Aimee Custis, Communication Manager at the Coalition for Smarter Growth, wrote on the popular blog Greater Greater Washington, “[the] report is both a call to action and a baseline resource.”

Photo courtesy of Doug Canter.

Read the original story here >>

Why It May Soon Become Harder To Park In Some D.C. Neighborhoods

The District of Columbia’s Office of Planning is considering a proposal that would potentially reduce the number of available parking spaces in some neighborhoods.

Planning officials may submit a proposal this spring to the zoning commission eliminating the mandatory parking space minimums required for new development in transit-rich corridors and in downtown Washington. The idea squares with the vision of making the district less car-dependent and would let developers decide how many parking spaces are necessary based on market demand.

Opponents, however, say the plan denies the reality that roughly 70 percent of Washington-area commuters drive, and removing off-street parking requirements in apartment and office buildings would force motorists to circle city blocks looking for scarce spaces.

“This is a very dangerous proposal. We think it threatens the future of Washington, D.C.,” says Lon Anderson, the chief spokesman for AAA Mid-Atlantic, which represents motorists and advocates road construction as a solution for traffic congestion.

A city where a car isn’t a necessity

Thirty-nine percent of D.C. households are car-free. In some neighborhoods with access to public transit, more than 80 percent of households are car-free. Some recent developments wound up building too much parking to adhere to the mandatory minimums, including the D.C. USA shopping center in Columbia Heights, right next to a Metro station and busy bus corridor.

“The parking garage there is probably as twice as big as it needs to be, and the second level is basically not used, so the city has had to scramble to find another use for it,” says Cheryl Cort, the policy director of the Coalition for Smarter Growth and advocate of the zoning change.

Developers favor eliminating the mandatory parking minimums, because the construction of parking garages, especially underground, is enormously expensive. Each underground space adds $40,000 to $70,000 to a project’s cost, according to Harriet Tregoning, the director of D.C.’s Office of Planning, who is working on the overhaul of D.C.’s zoning code. It was last updated in 1958, when planners assumed the automobile would remain the mainstay of individual transportation.

“No matter how much mandatory parking we require in new buildings, if the landlord is going to charge you $200 per month to park in the building and the city is going to let you park on the street for $35 per year, you may very well decide… to park on the street,” Tregoning says. “Many developers are finding they have parking that they can’t get rid of, that they don’t know what to do with. That’s really a stranded asset.”

Parking-free building coming to Tenleytown

On the corner of Wisconsin Avenue NW and Brandywine Street NW stands what used to be a billiards hall. The property, just a block from the Tenleytown Metro station, has been an eye-sore for years. Douglas Development is expected to redevelop the site this year, turning it into a mixed-use retail and residential space with 40 apartment units and no on-site parking.

“When the Zoning Commission looked at this site and DDOT did some analysis, they found a lot of availability of both on-street parking and off-street parking. There are actually hundreds of parking spaces around this Metro station that go dark at night,” says Cheryl Cort, whose group contends the construction of parking spaces drives up housing costs an average 12.5 percent per unit. If developers can’t find a market for those parking spaces, they pass the costs onto tenants.

Douglas Development, which declined to comment on this story, received an exemption from the zoning commission to avoid the parking minimum at the Tenleytown property. Situated close to Metro and planning to market the apartments to car-free residents, the developers escaped having to build 20 spaces under the current regulations in the zone (C-2-A).

Douglas’s plan may look sensible given the conditions in the neighborhood, but AAA’s Anderson says it will cause problems.

“Are you going to have any visitors who might drive there to visit you? How about your mom and dad, are they going to be coming in? Do they live locally or are they going to be driving in? If so, where are they going to park?” says Anderson.

Fewer cars in D.C.’s future?

In its fight against the parking policy change, AAA is being joined by community activists, who claim their neighborhoods will be clogged by drivers looking for parking. Sue Hemberger, a 28-year District resident who does not own a car, says Tregoning’s proposal is too harsh. In her view, District officials are making car ownership a hassle.

“What I see us doing in the name of transit-oriented development is pushing people who won’t forgo car ownership off the edge of the transit grid,” Hemberger says. “I’m worried about the future of certain neighborhoods and I’m worried about the future of downtown.”

Anderson says D.C. is waging a “war on cars,” but Tregoning says changes to zoning regulations are not designed to make motorists’ lives miserable. On the contrary, the planning director anticipates the number of drivers in the district will grow but they will have enough options to do away with car ownership, like the car sharing services of Zipcar and Car2Go.

“How does your walking, biking, or taking transit affect his ability to drive, except to make it easier?” Tregoning says in response to Anderson. “The national average household spends 19 percent of income on transportation. In the District, in areas well-served by transit, our number is more like 9 percent of household income. So we happen to think lots of choices are a good thing.”

In 2012 the city of Portland, Oreg., commissioned a study (pdf) to look at the relationship between car ownership and new development, after apartment construction with little to no on-site parking in the city’s inner neighborhoods raised concerns about the potential for on-street parking congestion.

The study found “that 64 percent of residents are getting to work via a non-single-occupant vehicle. Almost a third (28 percent) of those surveyed belong to car-free households; however, cars are still the preferred mode of travel for many of the survey respondents.”

About two-thirds of the vehicle owners surveyed in Portland’s inner neighborhoods “park on the street without a permit and have to walk less than two minutes to reach their place of residence, and they spend only five minutes or less searching for a parking spot,” the study found.

To Hemberger, the Portland study’s key finding is that people don’t give up car ownership just because they commute to work via public transit. In a city like Washington, Hemberger says, there will not be enough street spot to accommodate new, car-owning residents.

Decision could come this spring

The Office of Planning will submit the proposed removal of parking minimums to the Zoning Commission later this month or early April, where it will go through the public process again before a final decision is made.

“We are a really unique city because we have an amazing number of transportation choices. Our citizens end up paying a lot less for transportation than the rest of the region,” Tregoning says. “I don’t understand why that would be considered a war on cars to try to give people choices, the very choices that actually take automobiles off the road to make it easier to park, to make it easier to drive with less congestion.”

Photo courtesy of Victoria Pickering on Flickr

D.C. Considering Lifting Mandatory Parking Minimums

The District of Columbia’s Office of Planning is considering a proposal to potentially reduce the number of available parking spaces in some neighborhoods as new development attracts more residents and jobs. If successful, it will mark the first major change to the city’s zoning code since it was first adopted in 1958.

It’s part of a growing city attempt to reduce congestion by offering its residents alternatives to the automobile – from bikes to buses to making walking more attractive.

Planning officials may submit to the zoning commission this spring a proposal to eliminate the mandatory parking space minimums required in new development in transit-rich corridors and in downtown Washington. The idea squares with the vision of making the district less car-dependent and would let developers decide how many parking spaces are necessary based on market demand. However, opponents say the plan denies the reality that roughly 70 percent of Washington-area commuters drive and removing off-street parking requirements in apartment and office buildings would force motorists to circle city blocks looking for scarce spaces.

“This is a very dangerous proposal. We think it threatens the future of Washington, D.C.,” says Lon Anderson, the chief spokesman for AAA Mid-Atlantic, which represents motorists and advocates road construction as a solution for traffic congestion.

A city where a car isn’t a necessity

Thirty-nine percent of D.C. households are car-free. In some neighborhoods with access to public transit, more than 80 percent of households are car-free. Some recent developments wound up building too much parking to adhere to the mandatory minimums, including the D.C. USA shopping center in Columbia Heights, which is right next to a Metro station and busy bus corridor.

“The parking garage there is probably as twice as big as it needs to be, and the second level is basically not used so the city has had to scramble to find another use for it,” says Cheryl Cort, the policy director of the Coalition for Smarter Growth and advocate of the zoning change.

“Rather than having the government tell the private sector how many parking spaces to build, we think it’s better for the developer to figure out how it best wants to market those units,” Cort added.

Developers favor eliminating the mandatory parking minimums because the construction of parking garages, especially underground, is enormously expensive. Each underground space adds $40,000 to $70,000 to a project’s cost, according to Harriet Tregoning, the director of D.C.’s Office of Planning, who is working on the overhaul of D.C.’s zoning code. The code was last updated in 1958 when planners assumed the automobile would remain the mainstay of individual transportation.

“No matter how much mandatory parking we require in new buildings, if the landlord is going to charge you $200 per month to park in the building and the city is going to let you park on the street for $35 per year, you may very well decide… to park on the street,” Tregoning says. “Many developers are finding they have parking that they can’t get rid of, that they don’t know what to do with. That’s really a stranded asset.”

Parking-free building coming to Tenleytown

On the corner of Wisconsin Avenue NW and Brandywine Street NW stands what used to be a billiards hall. The property, just a block from the Tenleytown Metro station, has been an eyesore for years. Douglas Development is expected to redevelop the site this year, turning it into a mixed-use retail and residential space with 40 apartment units and no on-site parking.

“When the Zoning Commission looked at this site and DDOT did some analysis, they found a lot of availability of both on-street parking and off-street parking. There are actually hundreds of parking spaces around this Metro station that go dark at night,” says Cheryl Cort, whose group contends the construction of parking spaces drives up housing costs an average 12.5 percent per unit. If developers can’t find a market for those parking spaces, they pass the costs onto tenants.

Douglas Development, which declined to comment on this story, received an exemption from the zoning commission to avoid the parking minimum at the Tenleytown property. Situated close to Metro and planning to market the apartments to car-free residents, the developers escaped having to build 20 spaces under the current regulations in the zone (C-2-A).

Douglas’s plan may look sensible given the conditions in the neighborhood, but AAA’s Anderson says it will cause problems.

“Are you going to have any visitors who might drive there to visit you? How about your mom and dad, are they going to be coming in? Do they live locally or are they going to be driving in? If so, where are they going to park?” says Anderson, who says the past three years have seen 16,000 new car registrations in Washington.

Fewer cars in D.C.’s future?

In its fight against the parking policy change, AAA is being joined by community activists who claim their neighborhoods will be clogged by drivers looking for parking. Sue Hemberger, a 28-year district resident who does not own a car, says Tregoning’s proposal is too harsh. In her view, district officials are making car ownership a hassle.

“What I see us doing in the name of transit-oriented development is pushing people who won’t forgo car ownership off the edge of the transit grid,” Hemberger says. “I’m worried about the future of certain neighborhoods and I’m worried about the future of downtown.”

Anderson says D.C. is waging a “war on cars,” but Tregoning says changes to zoning regulations are not designed to make motorists’ lives miserable. On the contrary, the planning director anticipates the number of drivers in the district will grow but they will have enough options to do away with car ownership, like the car sharing services of Zipcar and Car2Go.

“How does your walking, biking, or taking transit affect his ability to drive, accept to make it easier?” Tregoning says in response to Anderson. “The national average household spends 19 percent of income on transportation. In the district, in areas well-served by transit, our number is more like 9 percent of household income. So we happen to think lots of choices are a good thing.”

In 2012 the city of Portland, Oregon, commissioned a study to look at the relationship between car ownership and new development, after apartment construction with little to no on-site parking in the city’s inner neighborhoods raised concerns about the potential for on-street parking congestion.

The study found “that 64 percent of residents are getting to work via a non-single-occupant vehicle. Almost a third (28 percent) of those surveyed belong to car-free households; however, cars are still the preferred mode of travel for many of the survey respondents.”

About two-thirds of the vehicle owners surveyed in Portland’s inner neighborhoods “park on the street without a permit and have to walk less than two minutes to reach their place of residence, and they spend only five minutes or less searching for a parking spot,” the study found.

To Hemberger, the Portland study’s key finding is that people don’t give up car ownership just because they commute to work via public transit. In a city like Washington, Hemberger says, there will not be enough street spot to accommodate new, car-owning residents.

Decision could come this spring

The Office of Planning will submit the proposed removal of parking minimums to the Zoning Commission later this month or early April, where it will go through the public process again before a final decision is made.

“We are a really unique city because we have an amazing number of transportation choices. Our citizens end up paying a lot less for transportation than the rest of the region,” Tregoning says. “I don’t understand why that would be considered a war on cars to try to give people choices, the very choices that actually take automobiles off the road to make it easier to park, to make it easier to drive with less congestion.”

Photo courtesy of vpickering on Flickr

Testimony before the Hon. Muriel Bowser, Chair, Committee on Economic Development and Housing Council of the District of Columbia regarding: DMPED Performance Oversight – affordable housing in public land deals

Please accept these comments on behalf of the Coalition for Smarter Growth. We are a regional organization based in the District of Columbia focused on ensuring transportation and development decisions are made with genuine community involvement and accommodate growth while revitalizing communities, providing more housing and travel choices, and conserving our natural and historic areas.

Recommit to leveraging public land dispositions for very low income housing in mixed use projects

We know that while the city has grown in population and income, low income D.C. residents are experiencing even greater difficulties finding housing they can afford. Thus public lands, and every other realistic tool we have available, should be used to help address this pressing need. Our recent report, Public Land for Public Good, shows that the District has and can do great things with its city-owned land. The creation of mixed income housing opportunities on public land is an important source of affordable housing for our residents.

We know that while the city has grown in population and income, low income D.C. residents are experiencing even greater difficulties finding housing they can afford. Thus public lands, and every other realistic tool we have available, should be used to help address this pressing need. Our recent report, Public Land for Public Good, shows that the District has and can do great things with its city-owned land. The creation of mixed income housing opportunities on public land is an important source of affordable housing for our residents.

We highlight the Hine Jr. High School redevelopment project next to the Eastern Market Metro station as a leading example of what a public land disposition should do. The project will offer a great mix of uses, close to 30 percent affordable housing, and a design compatible with a historic district. All of this occurs next to a Metro station, close to the core of the city. The project has been in process since 2008 when the former school site was offered for redevelopment. The project will provide 163,000 square feet of office space, 40,000 s.f. of retail, and a total of 159 housing units. Of the total, 46 units will be affordable, or 29 percent. The mix of affordability for the housing units is a good example of what the city should be seeking in LDAs: 5 units will be affordable at 30 percent AMI, 29 units at 60 percent AMI, 12 units at 80 percent AMI (in lieu of IZ). Other public benefits include reconstruction and opening of a block of C Street SE, and a public plaza along C Street.

The Hine School project pre-dates the current administration. We are concerned that the commitment to affordable housing in recent solicitations for public land dispositions, especially at the lowest income level, is declining. I would be surprised if a DMPED Land Disposition Agreement (LDA) ever again results in 30 percent AMI housing. Current practice by DMPED asks that any residential component meet or exceed Inclusionary Zoning standards of 8-10 percent set aside at 50-80% AMI. IZ is the law and what is required for any residential development. We should expect much more for public land.

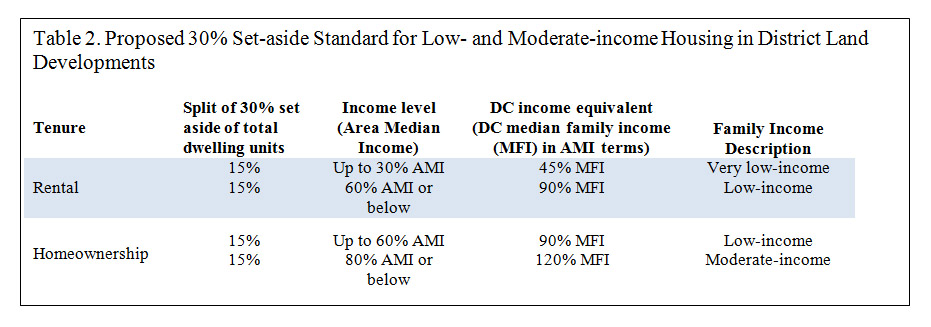

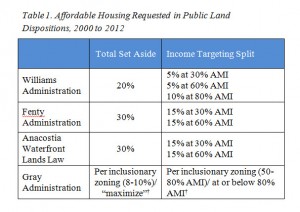

Table 1 shows the affordable housing set side and income targeting that was the practice of the last decade for solicitations in public land dispositions. Currently, DMPED’s solicitations provide little of the specificity that was the practice in the past. We urge the council to ensure that we are making the most of the unique opportunity to leverage the value of the District’s land to create more affordable housing through the land disposition process. We ask that the council recommit the District to clearly requesting and prioritizing proposals that offer substantial amounts of affordable housing, including units affordable to those earning 30 percent AMI. As was the practice in the past, we ask that requests specify the city is seeking 20 percent to 30 percent of the total number of residential units affordable at 30 percent and 60 percent AMI for rentals, and up to 80 percent AMI for ownership. We suggest table 2 as a model. In addition, we ask that DMPED better coordinate with other agencies to pool resources to ensure the production of housing affordable at deeply affordable levels as a part of larger mixed income or all-affordable development.

Management of Affordable Dwelling Units

Since 2009, DHCD created a group to manage affordable dwelling units (ADUs) created through LDAs and Zoning Commission actions, along with IZ units. Given the many challenges to helping moderate and low income households buy and maintain affordable homes, we suggest that this process might be best done through DHCD contracting with a qualified nonprofit. Resale assistance for a price controlled home could benefit from extra attention that a nonprofit could provide to a seller. While we have suggested this for IZ units, we also think that ADU management would similarly benefit.

Thank you for your consideration.

Sincerely,

Cheryl Cort

Policy Director

Testimony before the Hon. Muriel Bowser, Chair, Committee on Economic Development and Housing Council of the District of Columbia regarding: DHCD Performance Oversight – Inclusionary Zoning

Please accept these comments on behalf of the Coalition for Smarter Growth. We are a regional organization based in the District of Columbia focused on ensuring transportation and development

decisions are made with genuine community involvement and accommodate growth while revitalizing communities, providing more housing and travel choices, and conserving our natural and historic areas.

We would like to comment on DHCD’s administration of the Inclusionary Zoning program. We have been involved with Inclusionary Zoning (IZ) since its beginning in 2003 and remain committed to ensuring that this important affordable housing program delivers on its promise. We are gratified that IZ is finally becoming a reality on the ground given the delays in issuing regulations, the housing market collapse, and extensive grandfathering. The start up of this program has faced many serious challenges, but we believe all these challenges can be overcome. We first want to remind the Committee of the importance of this affordable housing tool that produces below market rate units in matter of right developments throughout the city with no cash subsidy from the District. Of unique importance, IZ creates below market rate units in neighborhoods where few or no affordable units are likely to be produced in the future. This is a valuable affordable housing tool practiced by hundreds of jurisdictions throughout the country, including Montgomery County. This approach is credited with achieving economic integration is ways that other affordable housing programs are unable to achieve.

Montgomery County’s experience is instructive for looking at D.C.’s pathway to successful implementation. The county has produced over 13,000 IZ units since 1976. Due to short affordability terms, currently only 2,600 units are still affordable at 65 percent area median income (AMI). In addition, another 1,573 IZ units that were purchased by the county’s housing authority are rented to lower income families (this is through a provision in the county’s law that D.C.’s prohibits). The county’s IZ program provides nearly half of its affordable housing production. Among the changes the county has made to its program over the years are: extending the affordability term to 30 years for ownership and 99 years for rental; allowing income targeting to rise from 65 percent AMI to 70 percent AMI for high rise construction, and elimination of a troubled buy-out provision that allowed fees in lieu of on-site construction of units.

Administration of D.C.’s IZ program requires urgent and specific attention to ensure that as the over 900 units come online in the next 5 years, implementation will be smooth for all parties. We now face three key administrative challenges that can be fixed: severe understaffing, FHA rules, and overly rigid administrative regulations. Below are our recommendations for these key challenges.

Administrative problems that must be resolved immediately

1. Severe understaffing –1-2 overworked staff members are struggling to launch a new IZ program and provide oversight for roughly 2,000 affordable dwelling units (ADUs) already built or in process, created by PUDs (in lieu of IZ) and public land dispositions. Staff will be difficult to retain and attract if capacity is way below a realistic workload. Program applicants and developers will also not get the assistance they require.

Recommendation: Budget more staff and contract to a qualified homeownership organization

experienced in permanent affordability:

a. Add 2 additional staff positions;

b. Contract with a nonprofit group experienced in managing the homeownership purchase process and stewarding permanently affordable homes. Given the extra challenges of affordable home purchasing in a post-2008 economy, more assistance to homebuyers is needed to speed up the sales process. A nonprofit experienced in selling and stewarding permanently affordable homes could manage the homebuyer recruitment, preparation, qualification, selection and placement process. This nonprofit can also provide effective relationships with mortgage lenders and developers to secure financing, along with ongoing stewardship, enforcement, and resale assistance. This kind of close working relationship with buyers and owners is likely going to be more effectively created through a nonprofit dedicated to successful affordable homeownership and permanent affordability than a government agency;

c. Sustain housing counseling assistance for IZ applicants.

2. FHA conflict with local covenants regarding foreclosure – The Zoning Commission has revised the regulations to conform with FHA rules, and DHCD is working to get FHA’s final approval. After FHA clarifies its acceptance of the D.C. program, DHCD needs to educate mortgage lenders and recruit them to offer mortgages for IZ units. Bank of America, for example, reviews and approves IZ programs for their mortgage lending. DHCD should ensure that D.C.’s IZ program gets onto Bank of America approved list, along other lenders’ lists.

3. Rigid regulations – The administrative regulations are currently being revised but it is urgent that we expedite these revisions given the many barriers they place to an efficient matching process for applicants and units. Given the difficulty matching qualified and interested applicants to units, we suggest suspending overly prescriptive lottery requirements until a lottery is needed to fairly allocate a unit among a larger pool of qualified applicants.

Policy issues for future consideration

Beyond the immediate administrative issues that should be our top priority, longer term policy issues should be considered to fine tune the program. The robust recovery of the housing market in D.C. over the last few years demonstrates that IZ is not a deterrent to housing production. For example, over 4,500 housing unit permits were issued in 2011. This is 64 percent greater than the last peak in the market in 2005 when over 2,750 permits for housing units were issued. D.C. housing production has gone from a few percent to more than half of the region’s residential output.

The experience to date on the development review and financing phase of IZ is that the economics work. Over 900 IZ units are in the pipeline at various stages of development approvals, and construction, with a handful of completed projects. This development pipeline demonstrates that financing for projects subject to IZ is not a problem. IZ policy standards have also contributed to creating approximately 1,000 affordable dwelling units (ADUs) through PUDs since the mid-2000s.

We flag the following policy issues for further assessment, as we act immediately to fix the administrative problems discussed above.

1. Income targeting: Current income targeting is at 80 and 50 percent AMI. Given that market conditions have changed since 2006, is income targeting still at the right levels? How many 50 percent AMI units can we expect to produce? How effective is the 80 percent AMI income targeting in providing units sufficiently below market?

2. Condo fees – while IZ standards have avoided the problems that early ADUs experienced before IZ policies were developed, unpredictable rises in condo fees could pose a problem in the future.

Recommendations:

a. Require par value assessments for condo fees for IZ and ADUs: Rising condo fees over time are potentially a problem even though IZ incorporates an initial fee based on what is projected to be a realistic fee to ensure that the overall housing payment by the buyer does not exceed a certain percent of her or his income. To avoid future excessive increases in condo fees, we suggest requiring that at least for IZ units and ADUs, par value tied to the affordable price of the unit be the basis for assessing the condo fee rather than a square footage basis. This will allow condo fees to rise as inflation and costs rise without subjecting the owner to a rapid escalation that would make the condo fee too expensive for the affordable unit owner.

b. Initial fee setting: This is already addressed by IZ regulations but could affect a building as a whole if a developer sets fees too low to support ongoing building costs. Given this problem for all condo owners, we recommend strengthening consumer protection against lowballing condo fees. Enabling OP and DHCD to comprehensively collect data on condo fee rates from existing buildings would provide these agencies the information they need to appropriately set condo fee rates as a part of the purchase price of an IZ unit or ADU. Secondly, consumer protection for condo purchasers can be improved by changing how the verification of the initial condo fee is set. Currently a certified third party is paid by the developer to verify the fee. We suggest charging the developer a fee that would have been paid to the third party, and have the city contract with a third party directly to verify the condo fee.

Overall, IZ is a sound policy that requires focused attention to address the administrative hurdles to a smooth-running program. The program promises to provide a substantial new source of below market rate housing throughout the city. While the program faces challenges, it is worth the effort. We thank the D.C. Council for its long-standing support for this innovative affordable housing policy.

Thank you for the opportunity to testify.

Cheryl Cort

Policy Director

More bus service may come to 16th Street’s southern half

WMATA might beef up service on the busy 16th Street (S) line with a bus starting in Columbia Heights, where existing S buses often become too full to pick up passengers. That was one of the options WMATA and DDOT bus planners discussed with riders at a meeting last Monday.

Every bus commuter knows that during morning rush hour, the people who board a bus early in the route are the ones who get the seats. They can get some reading or work done, or fit in one final snooze before they start their days.

But to riders who board the 16th Street “S-line” buses on the the southern half of the route, it’s not just a matter of getting a seat. Full buses pass them by, one after another, during the morning crunch. More and more commuters in that section have been giving up on the bus altogether and either waste money and gasoline on taxis and cars, or walk relatively long distances, making them late to work.

25 residents packed a daycare room at the Jewish Community Center on a cold and rainy night last Monday evening and shared not only their frustrations, but also their thoughtful ideas. Express and Current reporters also were there. Dozens of residents who could not attend emailed me their concerns and ideas, which I shared with WMATA officials.

For example, rider Mary M. wrote,

Just this week (Tues, Wed, and today, Thurs), it has taken me 45-50 minutes to get from 16th & V to 14th & I, and anywhere from 4 to 6 buses have passed the stop each morning because they are too crowded to accept any more passengers. (Also, on Tuesday morning, 2 buses that had hardly anyone standing passed us by in the cold). There are usually 15-20 people waiting at V St in the mornings.

At the meeting, S bus riders heard from WMATA bus planners Jim Hamre and David Erion and DDOT’s Steve Strauss. All 3 have a wealth of experience with District bus service. They have worked to make improvements in the past, like the S9 express bus. Rapid population growth in central DC has created challenges for bus service to keep up, they said.

But they offered hope of addressing this problem without affecting service for those who live along the northern half of the route. On Friday, in a follow-up phone call, Hamre also told me that WMATA is working on new proposals which he can discuss with the community around the 3rd week of February.

New route could serve half of 16th, if there’s a space to lay over

One possibility discussed with Hamre during the meeting is a rush hour route focused on the morning problem strip: Columbia Road to downtown DC. But one obstacle is layover space

We asked whether the route could run for only the 8-9 am hour, and therefore perhaps avoid the need for the parking stop. But the availability of a layover space is a very important part of running a bus route, the planners said. Would the elusive search for bus-length parking in one of the most congested parts of town stall this idea?

After the meeting, my wife Divya, who often jogs to Rock Creek and back, suggested asking about using the existing turnaround area on Calvert Street, by the Duke Ellington Bridge, where the 90s bus lines end today. That is less than 5 blocks from Columbia Road, and then just another 5 blocks from the 16th & Columbia intersection.

Hamre was intrigued by the idea when we discussed it by phone. While it’s not ideal, he said he’d look into it, among other possibilities. (None of those possibilities include reducing service to the northern half of the S route).

Other ideas that came up at the meeting include posting bus supervisors along the current S line to efficiently reorder buses en route, and consolidating certain stops that are very close together (at least during rush hour) along 16th Street.

We are looking forward to seeing WMATA’s proposals later this month. As soon as the meeting is confirmed, we will share it here and elsewhere to hopefully get an even bigger turnout than the one we had last Monday. Thanks go to the Jewish Community Center for providing the space, WMATA and DDOT officials for attending, and Noah Smith, who collaborated with me to organize the event.

Photo courtesy of Jess J on Flickr

A few steps can fix Inclusionary Zoning

DC’s Inclusionary Zoning (IZ) affordable housing program has suffered from serious administrative problems in its start-up phase. As a policy, however, it is still sound, and is the right policy for DC’s future.

Photo from 2910 Georgia Ave.A handful of IZ units are on the market, along with over 900 units in the pipeline. There are also 1,000 units that came through the Zoning Commission’s Planned Unit Development (PUDs) process since 2000, using the same policy standards as IZ.

Unfortunately, 2 early IZ units sat on the market for more than a year, and the developer has sued the city to get out of the IZ requirement. This doesn’t reflect a fundamental flaw in IZ; rather, it arises from understaffing at the DC government and rigid local and federal regulations. There’s not much time to fix the sputtering implementation of this important affordable housing policy tool.

IZ brings many benefits

IZ sets aside 8-10% of new housing construction for households earning 50-80% of Area Median Income (a 50% AMI household of 3 earns $49,250 per year, a 80% AMI household earns $78,221 per year). IZ is worth fixing because we have plenty of evidence that this kind of program can produce results beyond what other housing programs can. IZ provides affordable housing in mixed-income and wealthier neighborhoods throughout a jurisdiction rather than concentrating it in a few neighborhoods.

This benefit of economic integration has been documented. Low-income children in programs like IZ perform better in school than their peers, because they live in low-poverty neighborhoods and attend local low-poverty schools. Another other advantage of IZ is that it does not require a direct subsidy from the government to construct the affordable unit, but rather lets the developer to build extra market-rate units, and uses that value to pay for the below-market ones.

Other than a nominal administrative cost, IZ is a very cost-effective way to sustain the city’s production of new moderately-priced homes. There are many successful similar programs throughout the country, including Montgomery County’s long-running IZ program, Moderately-Priced Dwelling Units (MPDUs).

DC IZ also has a sister program which creates affordable dwelling units through PUDs and public land deals. (Confusingly, these are often called ADUs, which is the same acronym, but not the same thing, as Accessory Dwelling Units, market-rate basement or garage units inside someone’s house). This program does not appear to have problems filling units at the same income levels. That success shows that IZ can also overcome its challenges with some concerted attention.

Three problems have stalled IZ

Three debilitating problems with the program’s administration can be fairly easily corrected and get it back on track: severe understaffing, rigid regulations, and rigid FHA lending rules.

Severe understaffing: Only 1-2 people administer the program inside DC’s Department of Housing and Community Development (DHCD). Without a few more staff people, IZ and the sister affordable dwelling units (ADUs) cannot be administered effectively. The Mayor and DC Council need to provide a few more staff positions to manage these programs.

An alternative to administering the program entirely inside the DC government would be to give responsibility for the for-sale units to a nonprofit experienced in managing permanently affordable homeownership programs. CityFirst Homes is already doing a similar job with the District’s first major housing land trust. Evidence suggests that more hands-on assistance from a non-profit like CityFirst Homes can drastically cut foreclosure rates and yield more successful homeowners.

The other component that requires sustained support is the housing counseling agencies who educate applicants and help them through the process. Ensuring the city’s budget provides for this is another key ingredient to success. In all, these administrative costs amount to a modest budget item and are a fraction of what it costs to subsidize new affordable housing construction.

Rigid IZ regulations: DHCD manages a process for connecting a person who qualifies for affordable housing to available units. This involves a centralized application and lotteries. Details of that process have proven too rigid to accommodate the realities of matching housing seekers and available units.

The city is in the process of revising the regulations to give the program necessary flexibility. This revision should be in effect in a few months.

An alternative to the current lottery system would be to let the developers market the units to qualified households, and simply have the District housing agency certify the applicants as qualified and provide general oversight. This is already the process for the PUD and public land “ADUs.”

With sufficient support from housing counseling agencies, residents in search of an affordable home should be able to get enough help to conduct that search, especially with the city’s useful website, dchousingsearch.org.

Rigid FHA lending rules: The Federal Housing Administration has emerged as the predominant mortgage backer in the post-2008 affordable homeownership world. Nationwide, most local housing programs have encountered a critical conflict with FHA rules where local programs (like IZ and ADUs) often require that the affordability provisions survive foreclosure. FHA does not allow for this.

The only way to deal with FHA mortgage lending standards that conflict with local program requirements is to change the program to conform to FHA’s standards, and get FHA to sign off on the changes. DC is acting to change its standards to comply with FHA. The timeline for receiving FHA’s approval is uncertain but the city hopes it will happen shortly, we hope in the next month or so.

If a unit goes into foreclosure and then sells on the market, the city would lose its investment in an affordable home. There are other safeguards the city could put in place that do not conflict with FHA. They would at least allow the city to recover the value of the affordability of the unit, should a foreclosure occur and the unit sell on the market.

With these three administrative fixes in place, DC should be ready to smoothly operate a program to place the right applicant in the right unit as 900 more IZ units come online.

Mend it, don’t end it

IZ’s growing pains have led to some calls to more fundamentally modify or scrap the IZ program. We should consider and debate these suggestions only once DC fixes the immediate problems and the program administration is running smoothly.

Some opponents continue to question the policy itself, but experience across the country points to IZ as a valuable and effective tool to create moderately-priced housing in strong markets with virtually no direct cost other than a small budget for staffing the program.

Photo courtesy of 2910 Georgia Ave.

Strategies Detailed to Remedy DC’s Affordable-Housing Crisis

Lack of affordable housing is an unintended consequence of a region’s success, and can certainly be seen in the Washington D.C. metro area.

As the public demand for walkable neighborhoods has increased, low- to moderate-income residents are being priced out of those neighborhoods. And unfortunately, the public policy regarding housing affordability in the United States remains “drive until you qualify.”

Thus began Chris Leinberger of the Brookings Institution at a recent seminar entitled “Walkable Neighborhoods: How to Make Them for Everyone,” sponsored by the Coalition for Smarter Growth.

The seminar also featured Ed Lazere of the DC Fiscal Policy Institute and David Bowers of Enterprise Community Partners, who brought their own unique spins on the affordable-housing problem in D.C.

Lazere illuminated some startling statistics regarding housing affordability (D.C. lost half of its low-cost apartment rental units from 2000 to 2010). Bowers added the human element with stories of how housing affordability has affected some actual D.C. residents (illustrating his concept that “data without stories are just numbers”).

Leinberger pointed out that Hollywood does more market research than any other U.S. industry, crediting the popularity of television shows such as Seinfeld and Sex and the City supplanting that of, say, Leave it to Beaver, as reflecting the national consumer demand for walkable neighborhoods away from suburban forms of development which remained in demand until the mid-1990s.

The result of this increased demand has naturally been an increase in land values in walkable communities, specifically in D.C.’s 139 designated activity centers. This, coupled with the lesser issue of increased construction costs associated with the development of walkable neighborhoods, according to Leinberger, has led to gentrification.

Bowers pointed to D.C.’s U Street and H Street corridors as the city’s two most recent neighborhoods to undergo gentrification which, Leinberger stated, was either good or bad, depending on where you sit.

The side effect of gentrification, of course, is pricing out D.C.’s low- and moderate-income residents from these neighborhoods, often displacing long-time residents in the process. And where are they to go? Bowers pointed out that 20 percent of D.C. residents spend half of every take-home dollar on housing already. “They are drowning,” Bowers said.

The main solution to housing affordability in walkable urban places, Leinberger stated, is simply to create more walkable urban places. This is a recognition that housing affordability in in-demand neighborhoods is, by definition, a supply/demand problem.

Leinberger enumerated additional remedies, of which the following is a subset:

- Offering standard tax credit and vouchers from the local government in lieu of increased tax revenues from other parts of the walkable urban district;

- Participating in federal government programs associated with the U.S. Department of Housing and Urban Development’s Choice Neighborhoods, the next generation of the department’s Hope VI programs;

- Instituting inclusionary zoning to require affordable units within a district with higher walkable urban infrastructure investment;

- Implementing fee capture upon resale of any market-rate unit within a district with such infrastructure investments;

- Allowing ancillary units in for-sale housing (i.e., “granny flats”) to expand the housing supply; and

- Encouraging employers to locate in transit-oriented developments in order to increase tax revenues in those districts.

These remedies are not just theoretical, but have been implemented in jurisdictions nationwide. Likewise, they are made possible based on increased profitability that does indeed occur in walkable neighborhoods.

Chris Leinberger dropped a staggering statistic regarding how much D.C. land values have increased in the past decade. On one particular site in Capitol Riverfront, he noted that the land value was probably at around $5 per square foot a decade ago. That same land was recently sold to Toll Brothers at a cost of $825 per square foot. “That increase is stunning,” he added.

In addition, in Arlington County, Virginia, the eight significant walkable neighborhoods occupying 10 percent of the county’s land today generates 55 percent of the county’s revenue, up from 20 percent just a few short decades ago. The county now captures part of this value growth by requiring that developers apportion a percentage of their residential units as affordable housing, or make a contribution to the county’s affordable housing fund.

While there is no one silver-bullet remedy, jurisdictions can, with perseverance, creativity, and hopefully a sense of urgency, address the “unintended consequence of success” that housing affordability poses as they create the walkable communities preferred by consumers of all socioeconomic backgrounds.

Click here to read the original article from Mobility Lab.

Photo courtesy of Paul Goddin.