Category: Affordable Housing

ALERT: Sign our letter to advance racial equity with the DC Comp Plan!

Join us in one more push: Sign the letter for racial equity

Dear Friend,

We’ll keep this short. We have joined with partners in a sign-on letter to urge passage of the DC Comprehensive Plan ASAP. If you haven’t already, please add your name.

The Comp Plan update is a fundamental part of the District’s commitment to address its legacy of racial inequity and the letter makes the case for Chair Mendelson and the Council to act quickly to pass the plan.

Please sign the letter today!

The proposed updates to the Comp Plan work to reverse redlining, racial segregation, and other discriminatory practices. It also acknowledges the consequences of past and current planning on Black and Brown residents, including: wealth disparities, health outcomes, and housing security.

The DC Office of Planning has identified nearly 100 policies and actions throughout the Comprehensive Plan that explicitly focus on advancing equity, titled the Equity Crosswalk. When implemented altogether, these policies hold promise to deliver on the goals of equity established in the Framework Element and to make a tangible difference in the lives of DC residents who have yet to reap the benefits of the growth and change in the city.

Thank you for sticking with us in the fight for the updated Comp Plan.

Cheryl Cort, Policy Director, Coalition for Smarter Growth

PS: Click here to learn more about the Comp Plan.

Photo Credit: S. Davis, Flickr.

RE: Support for Accessory Dwelling Units in Alexandria

January 23, 2021

Alexandria City Council

301 King Street

Alexandria, VA 22314

RE: Support for Accessory Dwelling Units in Alexandria

Dear Mayor Wilson and Members of City Council:

Please accept these comments on behalf of the Coalition for Smarter Growth (CSG), the leading organization in the DC region advocating for walkable, inclusive, transit-oriented communities. CSG appreciates the City of Alexandria’s efforts to develop an accessory dwelling unit (ADU) policy and writes to convey our full support of the proposal. CSG has become a leading expert on ADUs through our work in DC and our just-released DC ADU homeowners manual.

Accessory dwelling units can offer less expensive housing options than renting or buying a single-family home because of their smaller size. They are great for an aging parent you are caring for, offer a home for your recent college graduate, or a young professional just starting their career. ADUs can also offer a stream of income for homeowners, including lower-income homeowners and retirees on fixed incomes.

CSG is enthusiastic about the strong provisions being proposed that will help make the City’s program a success, such as allowing ADUs citywide, and enhance their feasibility and affordability by not requiring off street parking in our transit-rich, walkable city, and not requiring owner-occupancy on site.

An owner-occupancy requirement lacks flexibility for the homeowner and may limit one’s ability to build an ADU. It can make it difficult for homeowners to finance an ADU. This may serve to exacerbate income and racial inequities by limiting the ability of homeowners to construct ADUs to those with sufficient equity in their homes. An owner-occupancy requirement would also be limiting to people who must move on short notice, such as military and diplomatic families, who often choose to rent out their primary residence. We also note that single-family homes today are already frequently rented out by owners who are not living on site. The owner-occupancy requirement would be a barrier to constructing ADUs and undermine the goal of increasing the supply of ADUs in the city.

We encourage the city to include requirements for regular review, reporting, and recommendations by city staff on refinements to the program. This could include creating an affordability program for low-income renters or buyers, assessing size limitations and setbacks and their impact, whether or not the program has exacerbated or improved racial and income inequalities, and recommendations to address any other barriers towards creating new housing through ADUs.

We understand that some Alexandria residents who are opposed to ADUs and previously opposed the Seminary Road safety project have attacked CSG and our supporters as being outsiders. CSG is a longstanding, 24-year-old regional organization advocating for transit, safe streets, transit-oriented development, and affordable housing throughout the DMV and were honored with the Council of Governments’ (COG) Regional Partnership Award in 2017. Our staff live in Northern Virginia, Maryland, and DC and work with local advocates in each jurisdiction. We sent emails about the ADU program to our Alexandria members and subscribers encouraging them to participate in the ADU study process and to contact the City Council, and we remind our supporters that the emails on Alexandria issues are focused on Alexandria residents. At the same time, local elected officials meeting at COG have agreed that housing, like transportation, is a regional issue, requiring shared effort by every jurisdiction.

CSG believes the proposed ADU policy is a bold step forward in establishing a strong program that will help provide more housing options in Alexandria. Thank you for your time and consideration.

Sincerely,

Stewart Schwartz

Executive Director

Sonya Breehey

Northern Virginia Advocacy Manager

Take Action: Show your support for missing middle housing

Dear Sonya,

There are just two days left to provide your input on Arlington’s Missing Middle Study. You will find the presentation thought-provoking about the housing challenges facing Arlington, and by responding to the questions you will help us all think about the impact of high housing costs and options for addressing Arlington’s housing needs.

View the presentation and provide feedback

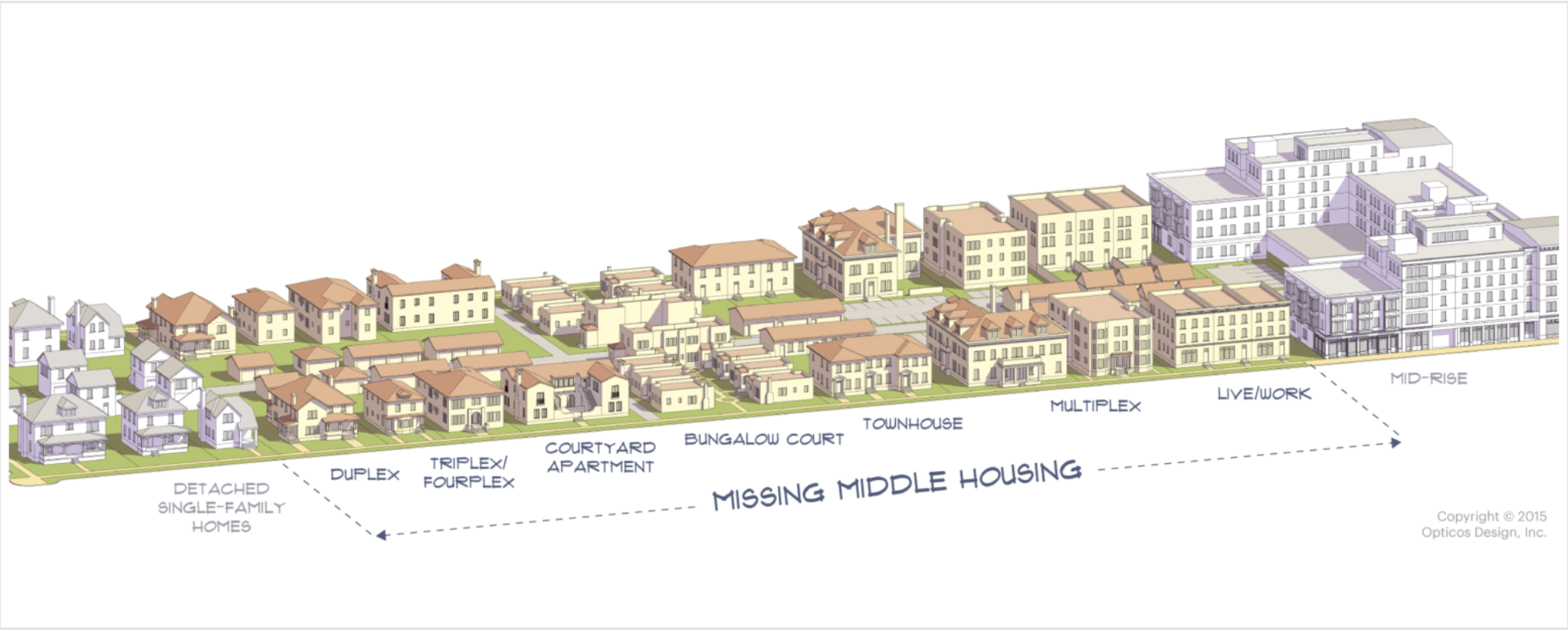

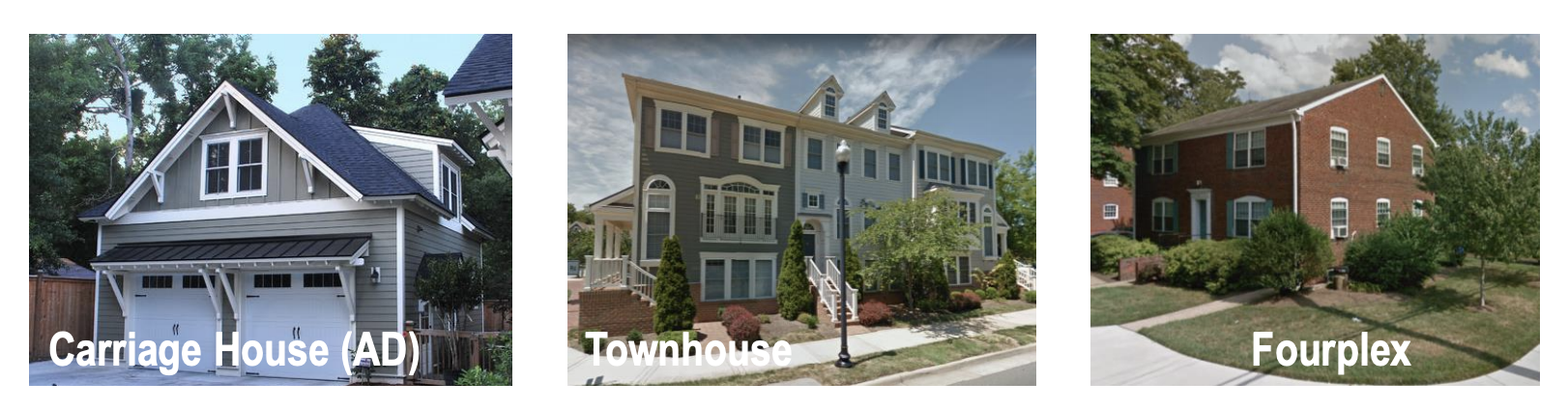

What is missing middle housing? “Missing middle” refers to the range of housing types that fit between single-family detached homes and mid-to-high-rise apartment buildings. Having different types and sizes of homes helps provide more options at different price points. Examples of missing middle housing include duplexes, triplexes, and townhomes. These images are some examples shared in Arlington’s Missing Middle presentation.

The opportunity to provide feedback ends December 31. Visit Arlington’s Missing Middle Study website for more information and to provide your input today!

What’s at stake in the Comp Plan update

This presentation explains what we won with the Framework Element in October 2019. The presentation also shows how the entire Comp Plan sets the District on a path to equitable distribution of affordable housing, and shows how the Future Land Use Map (FLUM) amendments create more housing opportunities focused around transit. The FLUM provides 15% more housing capacity to make room for more people as the city grows.

CSG Additional Testimony in Support of the DC Comp Plan, B23-736

This additional testimony provides support for passing the Comp Plan swiftly. If changes are being considered, we recommend improving language to support permanent housing affordability and support for Community Land Trusts. This testimony also endorses the testimony of the Douglass Community Land Trust, DC’s District-wide community land trust.

ADU D.C. Homeowner’s Manual

How to Build an Accessory Apartment or Second Dwelling in the District of Columbia

The ADU D.C. Homeowner’s Manual is a product of the year-long ADU DC initiative launched in the spring of 2019. This effort was made possible with the support of founding funder Citi, and led by the United Planning Organization (UPO), along with its partner, the Coalition for Smarter Growth.

For more information on how to build an ADU, view the full resource folder here. Also, join our online forum on DC ADUs here.